Apple is constantly being sued. But if some are doing it for the sole purpose of making money, after all, it is usually the injured party’s compensation that is relied upon to win the business, others honestly believe they have no other way to give back to their favorite company. Unfortunately, it is sometimes very difficult to distinguish between simple money grabbers and true fighters for justice. Moreover, if the lawsuit is not against the company as a whole, but against a representative of its management.

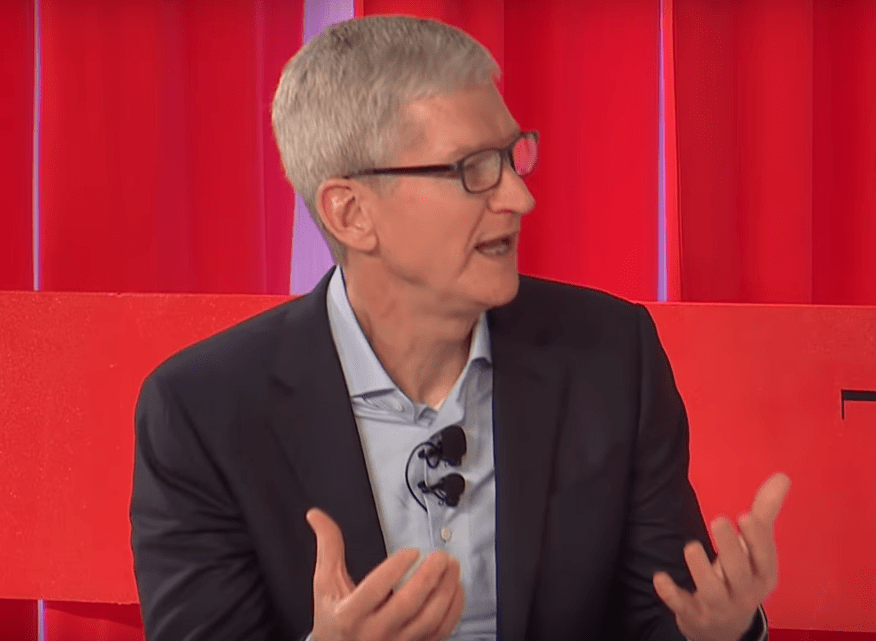

This week, the U.S. District Court in Northern California registered a lawsuit against Tim Cook and Luke Maestri, seeking to find them guilty of concealing important data about Apple’s business activities to prevent the company’s value from plummeting. According to the plaintiff, Apple’s CEO and COO deliberately withheld iPhone sales data because they knew that by disclosing the fact that declining demand would lead to a decrease in the company’s stock value.

How Apple is cheating us

But that’s not the only problem, the lawsuit states. Tim Cook ignored many questions from analysts at a conference about the company’s performance in the Chinese market, one of the key issues. The CEO noted that the company is feeling great, despite the upcoming holiday season, which is traditionally characterized by lower sales.

Another allegation described in the lawsuit is that Apple very easily “moved on” from the scandal of intentionally degrading iPhone performance with worn-out batteries. Despite Cupertino agreeing to replace the defective components for a significant discount, the company has chosen not to look into it in detail. And I should be confident in the plaintiff. After all, if users want to keep using the old iPhone instead of buying a new model, it’s clearly not to Apple’s benefit.

Endlessly bearing on the facts and substituting concepts that Cook and Maestri pursue leads to an incorrect assessment of Apple’s actions, Plaintiffs. Eventually, all the secrets will be revealed and the company’s stock will take an even more severe plunge than the one at the beginning of the year. In this case, shareholders will lose a fair amount of their investment, simply because management did not disclose the truth in a timely manner.